COBRA Insurance: Understanding the Basics and Navigating its Costs

Are you self-employed and in need of health insurance? Have you heard about COBRA insurance but find it perplexing? Look no further! In this article, we will explore the world of COBRA insurance, shed light on its high costs, and provide essential information to help you make informed decisions about your health coverage. So, let’s dive in!

What is COBRA Insurance?

COBRA, short for Consolidated Omnibus Budget Reconciliation Act, is a federal law enacted in 1985 that allows individuals to retain their employer-sponsored health insurance coverage even after leaving their job. It is particularly beneficial for self-employed individuals, as they don’t have access to employer-sponsored plans. COBRA acts as a lifeline, ensuring continuous coverage during transitional periods.

Understanding the Cost

COBRA insurance is often associated with high costs, which can be a deterrent for many individuals. The reason behind its expense lies in the fact that the entire premium burden shifts to the individual. Typically, employers subsidize a significant portion of the insurance premium, reducing the cost for employees. However, with COBRA, you are responsible for paying both your portion and the employer’s portion, resulting in a substantial increase in expenses.

Duration of COBRA Coverage

COBRA coverage lasts for a limited period, providing a bridge between employer-based insurance and alternative coverage options. Generally, it lasts for 18 months. However, certain circumstances, such as disability, divorce, or the death of the covered employee, can extend the duration to 36 months. This extended coverage can be a vital safety net during challenging times.

Pertinent Stats about COBRA Insurance

Cost Breakdown: On average, the cost of COBRA coverage can be three to four times higher than what you paid as an active employee. It’s important to evaluate these costs to determine the feasibility of COBRA versus other health insurance options.

Eligibility: To be eligible for COBRA coverage, you must have been part of a group health plan sponsored by a qualifying employer. Additionally, you must have experienced a qualifying event, such as job loss or reduction in work hours.

Limited Time Frame: It is crucial to understand that there is a specific window of time within which you must elect COBRA coverage. Generally, you have 60 days to enroll once you receive the COBRA election notice. Missing this deadline may result in losing this opportunity for continued coverage.

Navigating Your Options

While COBRA insurance offers temporary coverage, it’s essential to explore other long-term options to suit your needs as a self-employed individual. One such option is seeking assistance from a knowledgeable health insurance agent. A health insurance agent can guide you through the process of finding the right plan, comparing costs, and ensuring comprehensive coverage tailored to your specific requirements.

Schedule Your Free Consultation with 1099 Health Insurance Today!

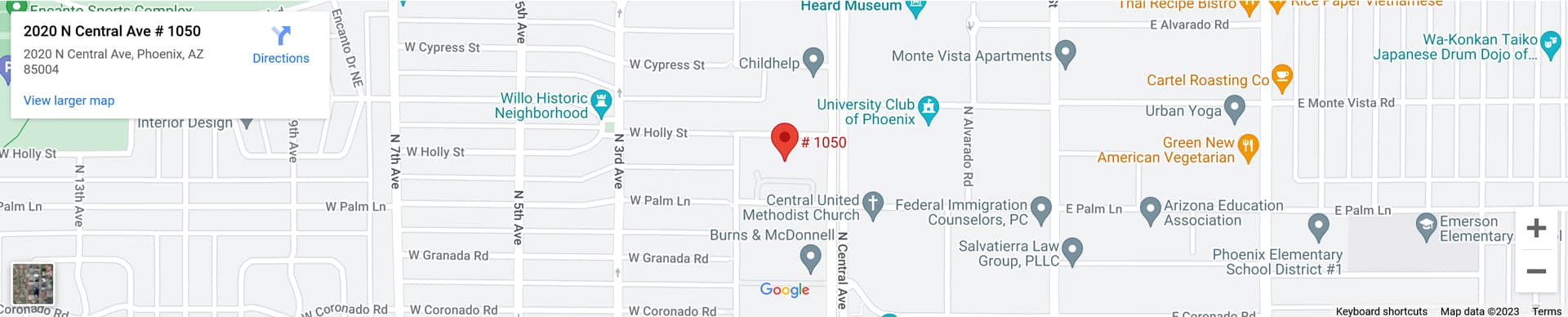

At 1099 Health Insurance, we understand the unique challenges faced by self-employed individuals when it comes to health insurance. Our expert team is here to assist you in making the best decisions for your healthcare needs. Take advantage of our free consultation to gain valuable insights and find the most suitable health insurance plan for your circumstances. Schedule your consultation today and secure your peace of mind!

Conclusion

COBRA insurance is a lifeline for self-employed individuals seeking continuous health coverage after leaving their job. Although it can be expensive, understanding its duration, costs, and eligibility criteria is crucial for making informed decisions. Remember, COBRA serves as a temporary solution, and exploring other long-term options, with the help of a trusted health insurance agent, is vital. Don’t wait! Schedule your free consultation