Your Comprehensive Guide to Self-Employed Health Insurance for 1099 Contractors

Congratulations on embracing the self-employed life! With close to 17 million self-employed workers in the US today, you’re part of a growing trend. Whether you’re pursuing entrepreneurship or enjoying the freedom of freelancing and contracting, managing your own health insurance is a crucial step.

In this guide, we’ll walk you through the various options for self-employed health insurance, empowering you to make informed decisions about your coverage. We’ll cover everything you need to know to protect your health and your business, ensuring you find the perfect solution.

COBRA: Continuation Coverage for Transition Periods

COBRA, short for the Consolidated Omnibus Budget Reconciliation Act, provides temporary coverage for up to 18 months in specific circumstances, such as job loss, death, divorce, or a decrease in working hours. While being self-employed alone doesn’t qualify you for COBRA, you may become eligible if you lose your job with a full-time employer. It’s worth noting that the responsibility of paying for COBRA coverage falls on the individual, including administrative fees.

When to consider COBRA:

If you’re content with your previous employer’s health insurance plan and want to maintain your current coverage while exploring other options, COBRA might be suitable. Additionally, if you’ve already met your deductible for the year or require expensive prescriptions, continuing coverage under COBRA could be financially sensible.

Keep in mind, that since your previous employer is no longer helping to pay for the plan, it can be pricy. Most COBRA plans are 2-5 times what you, the employee was originally paying towards your health insurance.

ACA/Government Health Plans: Affordable and Accessible Coverage

The Affordable Care Act (ACA), also known as Obamacare, provides federally sponsored health coverage. The ACA offers an annual Open Enrollment Period from November 1 to December 15, during which anyone can enroll or make changes to their plan. Special Enrollment Periods are available for life changes, such as moving, having a baby, adopting a child, or getting married. Medicaid, a program for low-income individuals and families, also falls under the ACA.

When to consider ACA plans:

ACA plans vary in terms of price and provider options. If you’re flexible with your choice of providers and eligible for subsidies, an ACA plan could be a suitable option. It’s especially beneficial if you have pre-existing conditions, as the ACA plan guarantees coverage. While navigating the marketplace can be overwhelming, the ACA hotline is available to address any questions you may have.

Private Plans: Customized Coverage Tailored to Your Needs

Private health insurance plans, offered year-round through insurance brokers, provide personalized coverage based on your budget and health requirements. Working directly with health insurers, these brokers can provide you with customized quotes, ensuring you find the best insurance options for your specific circumstances.

When to consider private plans:

If you’re ineligible for COBRA and won’t receive subsidies from the ACA marketplace, private plans are worth exploring. Pricing and coverage can vary significantly, making it essential to compare quotes and consider factors like pre-existing conditions, emergency coverage, and preventive care. With private plans, you’ll also benefit from excellent customer service, as brokers assist you with questions and resolve issues promptly.

Group Plans: Expanding Business and Attracting Top Talent

If you’ve expanded your self-employed business to include at least one employee, group health insurance plans can be a valuable recruiting and retention tool. Offering health insurance coverage to your employees can significantly enhance their satisfaction and loyalty.

How group plans work: As the business owner, you purchase the plan and decide on coverage details, copays, and deductibles. Employers typically contribute to a portion of the annual or monthly premium cost, while employees also share the expense.

When to consider a group plan:

If you’re planning to grow your business and already have at least one employee, offering group health insurance can be advantageous. Studies show that employees consider benefits like health, dental, and vision insurance as critical factors when choosing and staying with an employer.

Seek Expert Assistance for Self-Employed Insurance:

Choosing the right self-employed health insurance requires careful consideration. It’s essential to protect your health, as any disruptions could affect your work and business. Consulting with a reliable health insurance broker who specializes in self-employed coverage can be invaluable. They’ll confidentially discuss your health history, budget, and coverage preferences to help you make an informed decision for yourself and your family.

Conclusion:

As a self-employed individual, securing the right health insurance coverage is crucial for maintaining your well-being and protecting your business. By understanding the available options—COBRA, ACA plans, private plans, and group plans—you can choose the solution that best aligns with your needs and budget. Remember, don’t hesitate to seek professional assistance to ensure you make the right decisions when it comes to self-employed health insurance.

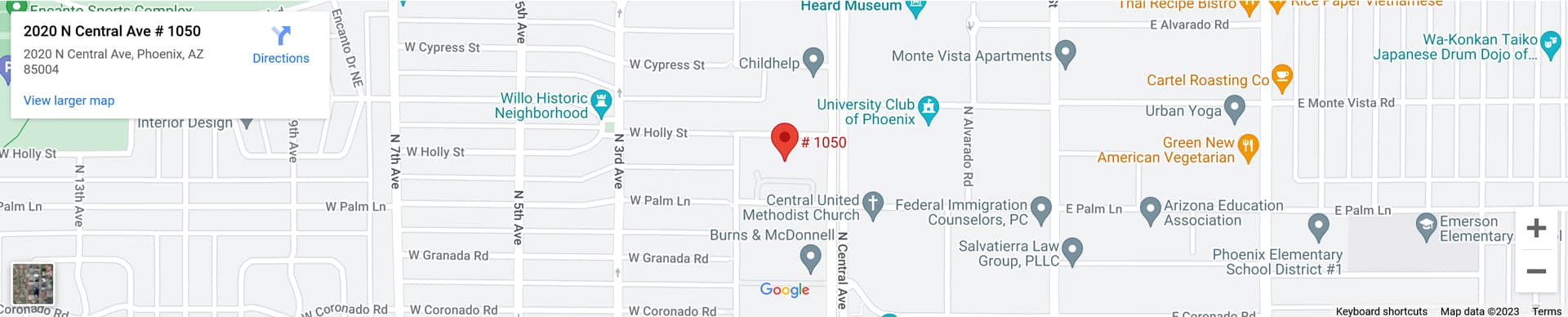

At 1099 Health Insurance, we specialize in helping self-employed business owners like you get the best health insurance available to them. Be sure to book a FREE consultation today.