Bringing Baby Home: A Guide to Maternity Costs and Health Insurance for the Self-Employed

Congratulations! You’re expecting a little bundle of joy. How much will it cost though?

This exciting time is filled with anticipation, but also questions, especially for self-employed individuals like you. One of the big ones: how much will it cost to deliver your baby?

Healthcare in the United States can be confusing, and maternity costs are no exception. This blog post will break down the average costs of delivering a baby in the US, with and without health insurance, focusing on options for self-employed individuals like yourself. We’ll explore marketplace plans under the Affordable Care Act (ACA) and typical employer plans, and offer tips on making maternity care more affordable.

The High Cost of Bringing Baby Home

Let’s get down to brass tacks. According to the Peterson-Kaiser Family Foundation (KFF) Health System Tracker, the average cost of childbirth in the US is a whopping $18,865. This includes prenatal care, delivery, and postpartum care for both mom and baby.

The Power of Health Insurance: A Buffer Against High Costs

Thankfully, having health insurance can significantly reduce your out-of-pocket costs. Here’s a breakdown of what you might expect:

- With Health Insurance: The good news is, with a health plan, you’ll likely pay a fraction of the total cost. The average out-of-pocket expense for childbirth with insurance is around $2,854 (source: Kaiser Family Foundation). This amount can vary depending on your specific plan. Here’s a closer look at two common options for self-employed individuals:

- Marketplace Plans (ACA Plans): The ACA, also known as Obamacare, provides a marketplace where you can shop for health insurance plans. Many of these plans offer maternity coverage. The cost of your plan will depend on your age, location, and the plan’s metal tier (Bronze, Silver, Gold, Platinum). Silver plans typically offer a good balance between monthly premiums and out-of-pocket costs for maternity care.

- Employer-Sponsored Plans (if applicable): If you’re lucky enough to have a spouse with employer-sponsored health insurance that covers maternity care, you can jump on their plan. However, keep in mind there may be additional costs for adding a dependent.

Without Health Insurance: A Financial Rollercoaster

If you don’t have health insurance, the full cost of childbirth falls on you. This can be a significant financial burden, with vaginal deliveries averaging $13,024 and C-sections costing a staggering $22,646 (source: ValuePenguin).

Making Maternity Care More Affordable: Tips for the Self-Employed

Even with health insurance, maternity care can be expensive. Here’s what you can do to manage the costs:

- Shop Around: For marketplace plans, compare plans during the Open Enrollment period (typically November) to find one that offers good maternity coverage at a price you can afford. Consider factors like deductibles, copayments, and coinsurance.

- High-Deductible Health Plan (HDHP) with Health Savings Account (HSA): An HDHP has a lower monthly premium but a higher deductible you must meet before your insurance kicks in. To offset these costs, consider an HSA, a special savings account you can contribute to with pre-tax dollars and use to pay for qualified medical expenses, including maternity care.

- Negotiate a Cash Pay Plan: Hospitals are often willing to work out a cash pay plan for maternity care. This can sometimes be significantly cheaper than going through insurance, especially if you don’t have a high-deductible plan.

- Maternity-Specific Supplemental Plans: These short-term plans can help cover some of the costs associated with maternity care. However, they typically have limitations and exclusions, so read the fine print carefully.

- Plan Ahead: Maternity care isn’t a surprise (usually!). Knowing you’re planning to start a family allows you to budget and potentially save for the associated costs.

Why are Maternity Costs So High in the US?

The high cost of maternity care in the US is a complex issue with several contributing factors, including:

- High Facility Costs: Hospitals charge a premium for their services, including labor and delivery rooms, neonatal intensive care units (NICUs), and medical staff.

- Physician Fees: Obstetricians, neonatologists, and anesthesiologists all charge fees for their services.

- Technology: Advancements in medical technology, while lifesaving, can also add to the cost of care.

- Administrative Costs: The healthcare system in the US is known for its complex billing and administrative processes, which can drive up costs.

Conclusion

Bringing a new life into the world is an incredible experience, but navigating the financial aspects of maternity care shouldn’t add unnecessary stress. By understanding your options and planning ahead, you can make informed decisions to manage the costs.

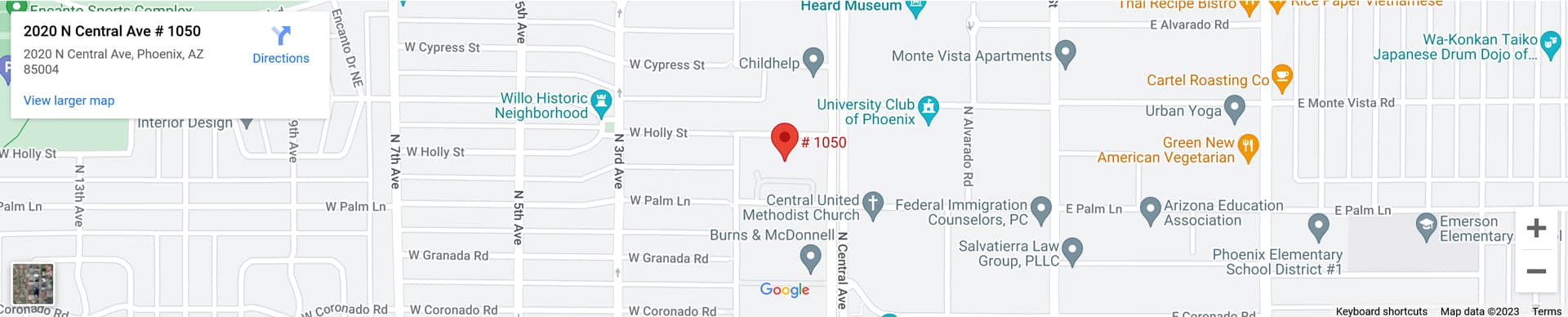

At 1099 Health Insurance, we understand the unique needs of self-employed individuals. While this blog post provides a helpful overview, maternity coverage can vary depending on your specific circumstances. Don’t hesitate to reach out to one of our experienced 1099 Health Insurance advisors for a personalized consultation. We can help you compare marketplace plans, explore options for managing out-of-pocket costs, and answer any questions you may have about navigating maternity coverage as a self-employed individual. Let’s focus on the joy of welcoming your little one, and we’ll handle the health insurance details. Contact us today for a free consultation!